Long tail MEV is perhaps the least explored and more mysterious part of this industry.

Even if there lacks a commonly agreed upon definition for this term, most searchers agree that "long tail" refers to all the extravagant and occult profit opportunities that are yet to be found by the majority of players.

That is, instead of focusing on optimizing arbitrage bots to lose some milliseconds of latency, rewriting them in faster languages or spending more money on expensive infra provisioning, the goal shifts to finding opportunities that almost nobody else is looking at, and capitalize on them.

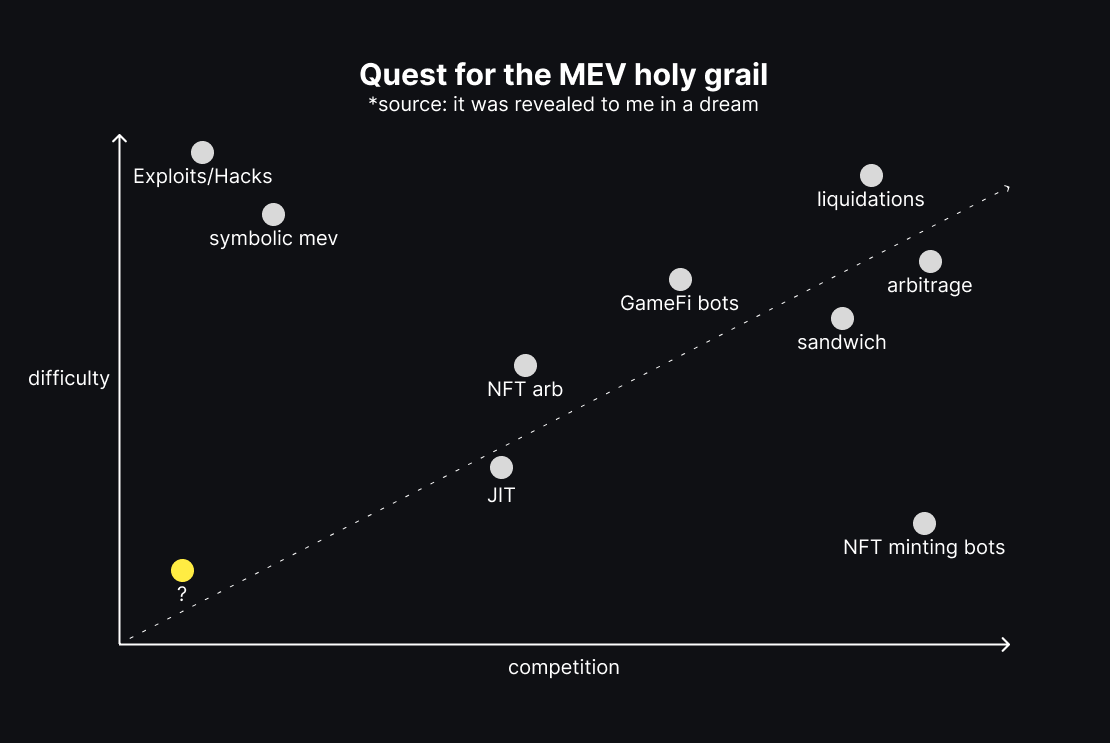

We could also say that long tail is simply the point with both minimal competition and acceptable execution difficulty. There are many other variables that also impact feasibility, but these are the main ones that stand out from other kinds of MEV extraction in my opinion.

I made a simple map of what I think long tail looks like in the MEV playing field:

The fact that you cannot find even an imcomplete list of recent long tail opportunities that have been found by searchers in the past is a testament to the fact that this strategies are actually viable and still generating value to this day, and being secretive is a key factor to their survival.

That said, I wanted to keep track of these opportunities when I see them on Twitter or Discord, and I decided to publish them here since writing things down is the best way for my brain to understand stuff.

List of some open-source long-tail MEV opportunities

1. sMEV: Synthetix ETH collateral program deprecation

Directly from the open-sourced repo from the awesome Bert Miller ⚡️

The repo linked above contains a searcher developed to take advantage of a 1 off MEV opportunity created by the Synthetix team deprecating their ETH collateral trial program. As a result of this there were many loans that would be liquidatable after the governance proposal was executed. Taking advantage of this required a bot that could backrun the governance proposal execution transaction from the mempool as well as monitoring and execution infrastructure.

Here is also a long-form blog post of this opportunity if you are interested.

Extra: User paco0x also has an open-source version of a bot for this opportunity. Both Robert and Paco didn't win the opportunity in the end, as there was someone else that paid the miners more or sent leaner flashbots bundles. To this day I still consider these repositories to be among the best learning resources for "MEV bot anatomy".

2. Flashside: Claim Otherside land NFTs

This is an extremely cool and unique use of MEV for NFTs. Open-source repo by noneother than Anish from Paradigm ✨

Flashside is a set of NFT MEV contracts to claim Otherside NFTs from various BAYC and MAYC pools, via flashloans or flashswaps. The basic idea of "Otherside land" was that every owner of a BAYC or MAYC would be able to claim an Otherside NFT for 2.5 ETH. Since there are a few liquid NFT markets such as NFTX, NFT20 and Looksrare, there was an arbitrage opportunity between the mint price and the price of the liquid pools.

For instance, one possible strategy consisted in:

- flashloaning ETH

- buying a BAYC from the NFTX pool

- minting the Otherside Land NFT

- selling the BAYC on the same pool

- selling the Otherside Land NFT somewhere (NFTX, NFT20, Looksrare, Opensea, etc)

- repaying the loan and keeping the profit

I liked this one particularly because it was a very simple idea economically speaking, the genius part was realizing that you could leverage liquid NFT markets for this, which was quite creative at the time.

3. Crabada auto-looting bot

Here is the open-sourced repo made by searcher Collins on Github 🏆

Crabada is a play2earn game developed on Avalanche. The game mainly consists in battles between crabs, where you can composse your NFT crab team and compete with others by playing and looting other teams. Of course, the more battles you won the more money you earned, as any classic play2earn model.

Collins made a bot in Go that would play every single day with the max number of teams and crabs, and loot automatically by calling smart contracts directly on the blockchain.

The Crabada team had to implement a CAPTCHA feature just to prevent bots from being able to ruin the game... but it was a bit too late. Collins was able to extract a hefty $500k USD profit in just 3 months of running the bot consistently. He wrote a detailed Twitter thread about it here.

I believe that opportunities like this are few and far between, but I am sure that we will hear more of these in the future. If you're reading this, you're probably already deep into the rabbit hole.